Surplus Weekly | 19 June 2025

Loan costs still bite, and late-paying buyers like Coca-Cola UK face public shame in UK. Your 5-minute founder brief.

Today’s edition helps you spot the right loans you should look for, the tech worth testing, and one habit that freed up cash for our own team last quarter.

Big picture:

Loan costs are still high, but founders are slightly more optimistic in getting loans as they grew more confident about future sales;

AI tools are getting cheaper to run on-device but dearer in the cloud;

New UK disclosure rules mean slow-paying corporates will be named and shamed.

Market Snapshot (90-second read)

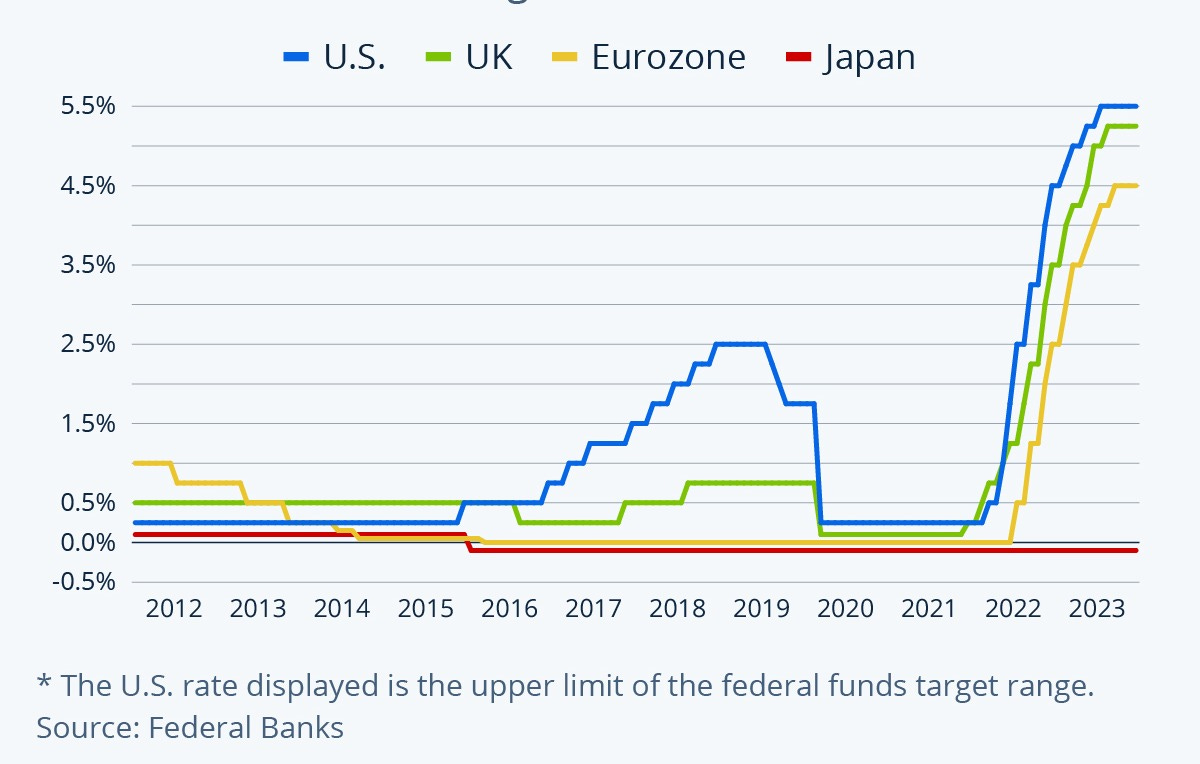

Rates on pause, so plan for the status quo

United States: The Federal Reserve lowered its interest rate by 1% to 4.50% yesterday and still plans two cuts later this year based on their H.15 release.

United Kingdom: The Bank of England held at 4.25% (6-3 vote), pointing to a possible first cut in August.

Euro area: The European Central Bank (ECB) trimmed again to 2.0% but signalled a summer pause.

Founder takeaway: Build cash-flow models that assume today’s rate sticks all year; history says easing cycles rarely move in a straight line.

Small-business mood: The National Federation of Independent Business (NFIB) Optimism Index rose to 98.8, creeping above its 51-year average—first time since 2022.

Funding flicker:

Defence-AI firm Helsing secured €600 m (≈$693 m) at a $12bn valuation—Europe’s biggest private tech round YTD.

Spend-management platform Ramp raised $200m at $16bn valuation. Signal: investors still love cost-saving tools.

Late-payment spotlight (UK): Based on UK’s Reporting on Payment Practices, large buyers must publish how many invoices they dispute or pay late. Until now Coca-Cola UK, Formula One Marketing and Reckitt are on list of firms ‘short-changing’ small businesses with slow payment of invoices. From April 2025, large companies and LLPs must publicly report if they hold back payments as a security deposit (usually 5–10%) until work is complete—spelling out which contracts this applies to, the total sums withheld, and when those funds are released.

Tech & AI Brief

Apple Intelligence goes hands-on. Developers can call the on-device language model with three lines of Swift—early testers report ~40% fewer cloud GPU calls.

Nvidia next-gen chips on deck. The DGX-H200 super-server and Blackwell Ultra GPUs ship late-2025, promising up to 1.7× faster inference. Reserve capacity before clouds re-price.

OpenAI eyes ads. Leaked briefings show GPT-5 (due this summer) could run ads outside answers to keep trust intact. Early brand pilots suggest cheap B2B leads while inventory is fresh.

EU AI Act clock is ticking. Full enforcement for high-risk uses begins August 2026, but some record-keeping duties start February 2025—plan audit trails now.

Field Notes

We expected faster invoice payments after the European Central Bank’s latest cut. Instead, construction firms stretched terms by seven days. We added “date of central-bank meeting” as a feature in Paystorm.ai’s risk model and improved late-pay predictions 11% on the next run.

Lesson: macro events show up in your receivables quickly—calibrate reminders around policy dates, not just due dates.

Quick Tools (DIY)

Apple On-Device Starter: Apple’s sample repo lets you summarise an email inbox locally. Download the Swift playground here ↗︎.

Payment-Terms Tracker: Paste your top 20 customers into a simple table: invoice date | promised days | actual days. Review monthly; highlight any slippage.

Funding Watch List: Set a free Crunchbase alert for tags “SME SaaS”, “payments”. Helsing and Ramp popped up here first.

Running tight on cash because customers drag their feet and pay invoices late? Paystorm.ai plugs into Xero and QuickBooks, reminds slow payers automatically, and predicts who’s next to stall. Get started today for free.

See you next week,

Surplus Weekly Team

(Sources: Reuters, Bloomberg, NFIB, GOV.UK, TechCrunch, The Verge, Apple developer blog, Nvidia GTC notes, European Commission press releases.)